2024 Financial Triumph: Bank Reconciliation | Optimize Your Finances with Expert Bank Reconciliation

In the fast-paced world of personal and business finance, a vital but often overlooked element is bank reconciliation. Today, let’s embark on a comprehensive exploration of a ‘Bank Reconciliation Example’ to demystify this financial process that impacts us all.

Unveiling the Basics

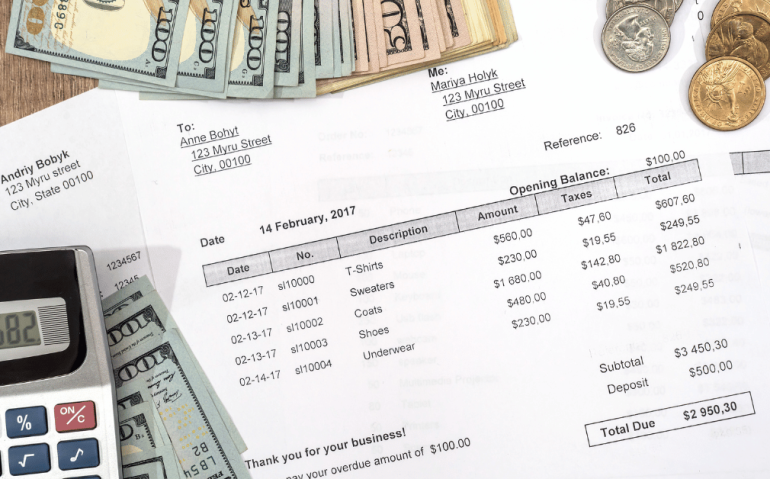

1. Understanding Bank Reconciliation At its core, bank reconciliation is akin to solving a puzzle. It involves a meticulous comparison of your financial records with your bank statement to ensure a harmonious match. Picture it as double-checking your financial backpack to guarantee you haven’t inadvertently left any coins behind.

2. Why It Matters to You? Have you ever scrutinized your bank statement, only to discover a mysterious charge that left you scratching your head? Enter bank reconciliation – your detective hat in the financial world. This process helps unveil discrepancies, ensuring your hard-earned money stays exactly where it belongs – in your wallet.

The Tools You Need

3. Bank Statement Think of your bank statement as your financial roadmap – a monthly guide showcasing your transactions, charges, and deposits.

4. Accounting Software Equipping yourself with accounting software is akin to having a modern-day compass. Software like QuickBooks or Xero serves as a guide, helping you navigate and track your financial journey.

Step-by-Step Walkthrough

5. Gathering Information Envision preparing for a road trip. You gather your map, snacks, and ensure a full tank of gas. Similarly, in bank reconciliation, you assemble your financial receipts, invoices, and your bank statement – the essentials for your financial journey.

6. Matching Transactions Consider it as finding the missing pieces of a puzzle. Methodically match each transaction in your records with those on your bank statement. Highlight any discrepancies – those missing puzzle pieces – to ensure a complete financial picture.

7. Addressing Discrepancies Encountered a hiccup in your financial journey? Dive into the details, identify the missing pieces, and take corrective action. It’s akin to fixing a detour in your travel plans.

8. Updating Records Just as you would update your travel log to reflect the twists and turns of a journey, ensure your financial records accurately mirror the corrected information post-reconciliation.

Pitfalls to Avoid

9. Ignoring Small Discrepancies Remember, small leaks can sink big ships. Similarly, ignoring tiny discrepancies in your financial records may lead to more significant financial woes down the line. 10. Neglecting Regular Reconciliation Think of your finances like a car that needs regular check-ups to function optimally. Similarly, consistent reconciliation is crucial for maintaining the financial health of your accounts.

Bank reconciliation is not just about balancing numbers; it's the art of aligning your financial compass, ensuring every dollar finds its rightful place in the symphony of your financial harmony.

The Benefits Unveiled

11. Financial Clarity Bank reconciliation acts as your financial flashlight. It illuminates your financial path, providing clarity and understanding, allowing you to make informed financial decisions.

12. Fraud Prevention Consider it your money’s security guard. Regular reconciliation serves as a proactive measure, helping spot and prevent any fraudulent activities, ensuring your financial security.

The Role of Bank Reconciliation in Daily Life

13. Personal Finance Management Bank reconciliation is not just for businesses. It’s equally crucial for individuals managing their personal finances. Regular reconciliation ensures that every dollar is accounted for, preventing unexpected financial surprises.

14. Budgeting with Precision For those striving to stick to a budget, bank reconciliation is a game-changer. It helps you track your spending, identify trends, and stay on top of your financial goals.

In Conclusion

In the grand tapestry of personal finance, bank reconciliation serves as the stitching that holds everything together. By embracing this process, you ensure that your financial journey is smooth, transparent, and free of unexpected bumps.

FAQs - Navigating the Financial Waters

Ignoring regular reconciliation is like driving blindfolded. You might miss discrepancies that can snowball into significant financial issues over time.

Regular reconciliation ensures you catch discrepancies early, preventing potential financial headaches and maintaining the accuracy of your financial records.

Absolutely. Think of it as installing a security system for your money – regular reconciliation helps spot and thwart any fraudulent activities before they escalate.

Bank reconciliation acts as a proactive measure, enhancing your financial security and safeguarding your hard-earned money.

Just like your car needs regular check-ups, your finances benefit from monthly reconciliation. It's a proactive approach to catch discrepancies promptly and maintain financial health.

Monthly reconciliation is advisable to keep your financial engine running smoothly, ensuring you're on top of your financial game.

Address it promptly. Dive into the details, identify the missing pieces, and correct the information in your records to maintain the accuracy of your financial statements.

Timely action ensures that discrepancies are rectified, keeping your financial records accurate and reliable.

No, it's for everyone. Whether you're managing personal finances or running a business, bank reconciliation is a fundamental practice for financial health and transparency.

Bank reconciliation is a universal practice, essential for individuals and businesses alike, ensuring financial transparency and helping you navigate the complexities of your financial journey.

Exploring Advanced Bank Reconciliation Techniques

15. Automated Reconciliation Processes In the digital age, automation is revolutionizing bank reconciliation. Explore advanced tools that can streamline the reconciliation process, saving you time and reducing the margin for error.

16. Reconciliation Best Practices Delve into best practices for efficient reconciliation. From categorizing transactions to establishing a routine, these practices can enhance the effectiveness of your reconciliation efforts.

17. Real-world Case Studies Learn from real-world examples of how effective bank reconciliation has saved businesses from financial pitfalls. Case studies provide valuable insights into the practical application of reconciliation techniques.

18. Future Trends in Bank Reconciliation Stay ahead of the curve by exploring emerging trends in bank reconciliation. From blockchain technology to artificial intelligence, discover how these innovations are shaping the future of financial reconciliation.

In Summary

Bank reconciliation is not merely a mundane financial task; it’s a dynamic process that adapts to the changing landscape of finance. By understanding its intricacies, leveraging advanced techniques, and staying informed about future trends, you empower yourself to navigate the financial waters with confidence.

Sheheryar Javed

Explore the dynamic world of Accounting and Finance with insights from a seasoned professional. As an ACCA and MS Accounting & Finance graduate, I bring expertise to FinanceAccounting.us, offering valuable perspectives and practical tips for navigating the intricate realms of financial management and accounting

Categories

- Bank Reconciliation & Treasury Management

- Financial Statements & Reporting Analysis

- Financial Forecasting, Planning & Budgeting Analysis (FPBA)

- Accounts Payable vs Accounts Receivable

- Corporate Finance & Investment Management

- Financial Theories & Modelling

- Accounting & Finance

- Internal & External Audit

- Risk Management & Compliance

- Internal Controls & Assessment

- Statistical & Quantitative Analysis

- Corporate Governance & Social Responsibilities

- Micro & Macro Economics

- Personal Finance Advisory

- Financial Technologies & Transformation (FINTECH)

- International Financial Reporting Standards (IFRS)

- General Business Management

- Political Economy & International Financial Management

- Business Laws, Rules & Regulations

- Personal Life Experiences & Expectations